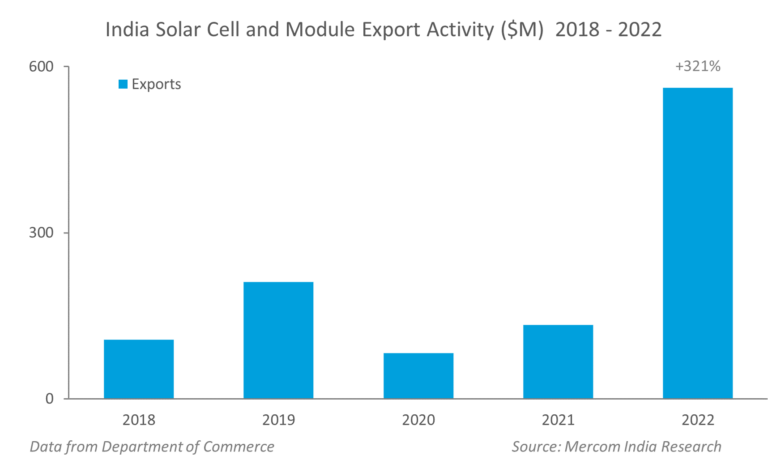

India’s solar module exports witnessed an unprecedented surge in 2022, recording a 321% hike year-over-year (YoY), totaling $561.6 million. It was primarily driven by demand from the United States, which accounted for over 95% of the shipments.

The emergence of the U.S. as the primary market for Indian solar modules is because of sanctions imposed by the United States on Chinese imports, triggered by the implementation of the Uyghur Forced Labor Prevention Act.

India’s solar module manufacturing capacity exceeded 39 GW at the end of September 2022 and is expected to reach ~95 GW by the end of 2025, according to Mercom India Research’s report, ‘State of Solar P.V. Manufacturing in India.’

Speaking to Mercom, an industry source said that while a ban on Chinese imports is the primary reason for surging exports from India, Indian manufacturers have also managed to carve a reputation as reliable, ethical, and trustworthy alternatives to Chinese suppliers.

“Southeast Asia, another possible supplier, has been known to be a location from where Chinese solar manufacturers assemble solar cells and modules before exporting them to the U.S. to circumvent antidumping and countervailing duties. Hence India is a safe bet for American companies due to the quality of exports and its traceability of ethical sourcing,” Suhas Donthi, Director of Sales and Operations at Emmvee India, said.

After an initial investigation, the U.S. Department of Commerce found that Chinese solar manufacturers bypassed duties by using Southeast Asian countries as their assembling base for exports to the U.S.

The export surge started during the July-September period when India experienced a 642% year-over-year in its exports of solar modules, totaling $157 million (~₹12.9 billion).

Is Exporting More Attractive for Domestic Manufacturers?

Sources were unanimous in their assessment that exporting solar modules and cells to the U.S. yields a higher profit margin than selling them in the Indian market.

Despite the relatively small export volume (1.5 GW-2 GW in 2022), the upward trajectory has worried developers that the diversion of domestic output towards exports might constrict the availability in India and raise prices.

However, manufacturers said they could increase their production capacity in response to rising domestic demand for solar modules and cells, ensuring that developers will not face supply disruptions. The manufacturing capacity of modules over 500W is estimated to be just around 10 GW.

However, with the government’s decision to suspend ALMM requirement for the current financial year, the concerns regarding shortage of domestic modules has also been mitigated.

Indian manufacturers are also looking at the impact of the Inflation Reduction Act (IRA) in the U.S. as it has attracted substantial investment in developing domestic supply chains for clean energy. The local manufacturing of modules in the U.S. could potentially dampen the momentum of India’s module exports. India is promoting its own domestic manufacturing in solar.

A senior executive at a major solar manufacturing company said that Indian manufacturers might consider setting up plants in the U.S. if the benefits outweigh the costs. However, the decision would depend on factors such as regulatory compliance, resource availability, and the overall business environment in the U.S., he added.

“Setting up a manufacturing base in the U.S. is something the industry is considering, but any immediate moves are unlikely from Indian players as the nuances of the IRA are not yet known,” said Donthi.

Detailed solar import and export data by component types, suppliers, manufacturers, and developers are available in Mercom’s India Solar EXIM Tracker.